AMP Deputy Chief Economist Diana Mousina looks at the issues that have led to the increasing wealth divide between older and younger Australians

Comparing wealth inequality has long been a popular debate in Australia, from popular slogans like “OK Boomer” to generalisations about the “smashed avo eating” millennial and Gen Z generations.

Around 70% of household wealth1 is tied to the value of our homes. In the short term, changes in household wealth can have implications for savings and spending. And in the long term, household wealth can affect retirement savings, reliance on the aged pension and living standards.

The wealth debate has extended into the impact of recent interest rate hikes.

First, let’s look at how higher rates have had different impacts on Australian households.

Winners and losers

Interest rate changes always affect households with a mortgage the most and 30% of Australian households have a mortgage.

Younger households are more likely to have taken out large mortgages in recent years at low rates, which now need to be serviced at higher rates, eating into their disposable income.

Older households’ disposable income hasn’t been hit as much because they tend to have less debt and can draw down on their savings to fund spending.

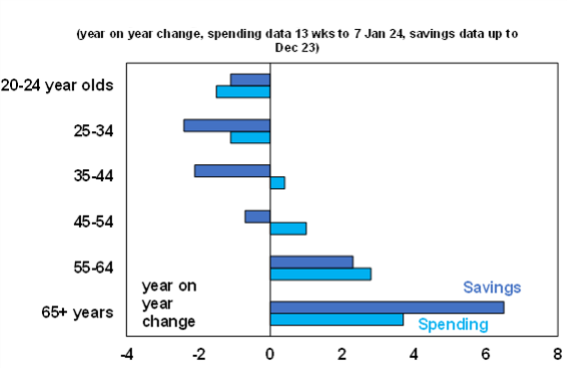

The chart below shows savings for younger households have fallen and spending growth has also been low. This reflects the fall in disposable income for younger households paying off mortgages as interest rates rise.

Meanwhile, older households have been increasing their savings and spending, with higher rates meaning higher savings rates.

Spending and Saving across Households

Source: CBA, AMP

Older generations understand the different conditions their children and grandchildren are facing. Recent AMP research showed 80% of Australians aged 65 and over believe their children face similar or harder financial challenges than they did.

Household income and wealth through time

To understand the current spending and savings habits of different generations, it’s useful to take a step back and look at the backdrop of income and wealth across different household age groups.

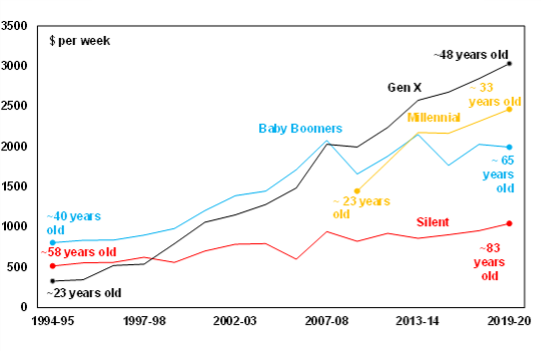

The chart below looks at household income. Gen X incomes started exceeding Baby Boomers from 2008, as they entered the peak point of their career and experienced higher incomes. Millennial incomes now also exceed Boomers and will exceed Gen X in under a decade when Millennials reach middle age.

Australia average household income by generation

Source: ABS, AMP

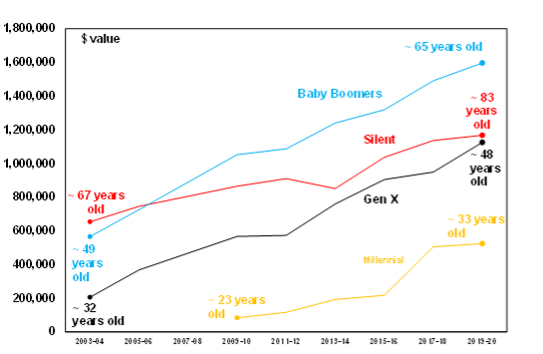

The next chart looks at household net worth. Each generation has enjoyed an increase in wealth over time. But the growth in Boomers’ wealth has been higher than other generations, which has increased the wealth gap.

Average Net Worth of Households By Generation

Source: ABS, AMP

So why have Boomers done so well? It’s really been down to good luck in asset prices, driven by the 40-year decline in interest rates that has lifted shares and home prices.

- Home prices have grown around 8% over the last 30 years – it used to take 6 years to save for a 20% deposit while now it takes nearly 11 years.

- Australian share prices have increased by over 9% over the same period.

- The superannuation guarantee has increased from 9% in the early 2000s to 11.5% this year, which is a form of forced saving.

The favourable treatment of housing as an asset (through the capital gains tax discount, negative gearing and exclusion of the family home from the aged pension test) has also helped to lift home prices, as has the chronic undersupply of housing in Australia.

But it’s not all doom and gloom…

Younger Australians are entering the labour market when conditions are tight, which should mean easier access to work although youth unemployment has been rising. Flexible work means more job opportunities. And high wages growth also means that starting incomes for young people are attractive.

The younger generation also seems to be taking on riskier investments, reflecting the more secure economic environment they’ve grown up in. Gen Z are much more likely to hold cryptocurrencies, international shares and exchange traded funds. This allows for large potential upside but also more downside if things go wrong.

The solution to the wealth divide? Make housing more affordable

The increasing divide in wealth between older and younger households is difficult to address because it mostly involves good luck for Boomers which can’t be undone. But what can be solved by policy is addressing housing affordability by increasing supply.

Improving housing supply can be done through:

- encouraging older households to downsize

- releasing more land

- speeding up approvals

- encouraging growth in regional centres

- investing in regional infrastructure.

Call us for a chat

Whatever stage of life you’re at – working or retired, Millennial or Boomer – we can help you make the most of your money.

This article has been written by Diana Mousina, Deputy Chief Economist at AMP.

Current as at June 2024

Important note: While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.

1 The conflicting priorities facing retirees and the ‘never leave home’ generations (amp.com.au)