AMP Deputy Chief Economist Diana Mousina takes a look at economic trends and what they mean for investors

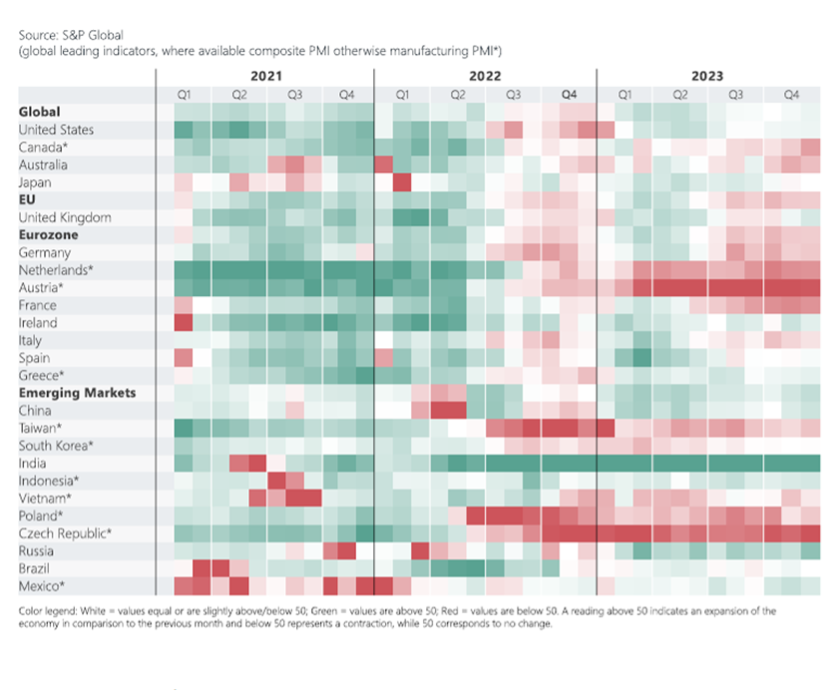

It’s been a difficult year for the global economy. As you can see in the heatmap below, GDP growth weakened in 2023, particularly in Europe and emerging markets.

Green and red lights for global growth

Source: Macrobond, AMP

But we’re seeing some growth signs, with the composite Purchasing Managers Index trending up since late last year.

So, let’s look in a little more detail at what’s happening in the major economies around the world in 2024.

US | Recession or not?

The US economy was surprisingly strong in 2023 despite higher interest rates. Annual GDP growth in the December quarter of 2023 was 3.3% and the March quarter this year is tracking at 2.9%.

Consumer spending has led the way, with positive contributions from government spending and business investment. Net exports and inventories have detracted from growth.

But there remains a moderate chance of a recession in 2024 as the labour market weakens, with job ads falling and the unemployment rate ticking up.

Meanwhile, inflation has dropped to 3.1% year on year, and we think it will be 2.5% by December as wages growth moderates. This should allow the US Federal Reserve to cut interest rates by mid-2024.

We expect GDP growth to slow to 1.4% over 2024, well below 2023 levels, but not quite consistent with a recession, which is positive for US earnings growth and the share market.

Eurozone | Rate cuts on the cards

Moving over to the Eurozone and GDP growth has barely increased over the past year, ending 2023 at just 0.1%. Weakness is evident across Germany, France and Italy, while Spain is holding up.

Growth has suffered from the slowdown in manufacturing and lower Chinese imports, which have weighed on Eurozone net exports. Inflation has dropped to 2.8% over the year to January 2024, down from a high of 10.6% in October 2022.

We think the European Central Bank will respond by cutting interest rates around mid-year, or slightly earlier. Along with better manufacturing conditions, this should see Eurozone growth improve to 0.9% in 2024.

China | Needs more stimulus…but may not get it

Let’s look at China, where the economy is facing growth headwinds.

- Consumer spending has yet to recover from lengthy COVID lockdowns.

- The property market is dealing with excess stock, overinvestment and developer problems.

- An aging population has reduced workforce productivity and participation.

- Chinese shares are down more than 40% since 2021, affecting consumer confidence.

China’s consumer prices are in deflation at -0.8% over the year to January 2024, which weighs on corporate earnings and household wages, and depresses sentiment.

Policymakers have focused on reducing borrowing costs, issuing corporate bonds and greenlighting infrastructure programs. But without further monetary and fiscal easing (particularly for households to increase confidence and encourage spending rather than saving), Chinese growth will remain subdued.

We expect GDP growth of around 4.6% in 2024 and 3% next decade. This is much lower than we’ve been used to – China was growing at around 10% between 2006-10. But given the Chinese economy is more than twice the size it was back then, it’s still making a sizeable contribution to global growth and demand for commodities, which is important for Australia.

Japan | Gently does it…

The Bank of Japan is the last major central bank that hasn’t tightened monetary policy following COVID, with the rate still below zero at -0.1%. Low interest rates have seen the Japanese yen lose more than 30% of its value since 2022.

The pressure is now building to start increasing rates, with consumer price inflation running at 2.6% over the year to December 2023.

But Japan’s historical difficulty in sustaining inflation and recent poor GDP growth (which has seen the country enter a technical recession) means the Bank of Japan will tread carefully. We see only 10-20 basis points of rate hikes likely this year.

What this means for investors

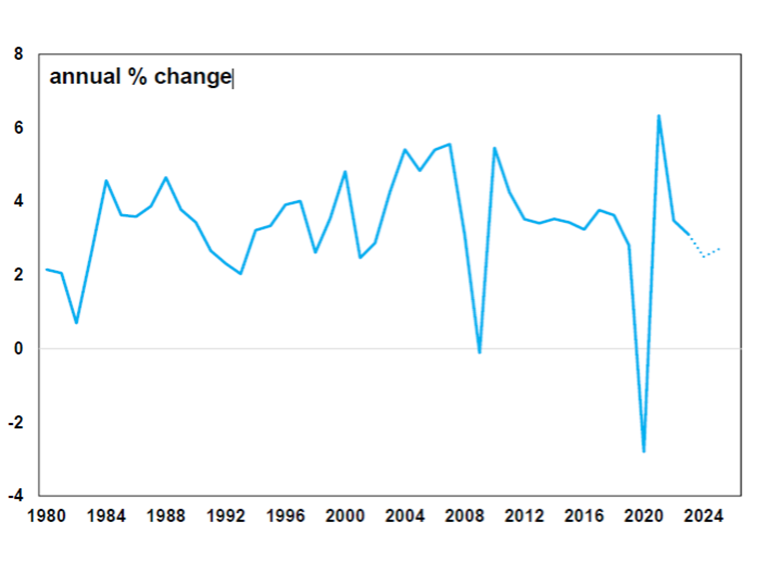

This year we see global GDP growth (which tends to average 3% over the long term) running at 2.5% after 3.1% in 2023 – see the chart below.

World GDP

Source: IMF, AMP

The International Monetary Fund is a little more optimistic, estimating 3.1% for 2024 and 3.2% for 2025.

Despite slower GDP growth, a global recession is unlikely in 2024. This is good news for earnings, and we expect share returns of around 7%. Lower inflation will allow many central banks to start cutting interest rates later this year, making way for stronger growth in 2025.

Geopolitics always matter for investors, but in 2024 even more so as around half the world’s population will have an election, which can cause uncertainty and volatility in share markets. The US Presidential election in November could potentially impact US fiscal policy (and how that translates to bond yields) and US trade policy (especially relating to China).

Geopolitical issues can also disrupt commodity prices and transport costs, which could impact inflation and delay rate cuts in 2024.

Current as at Mar 2024

This article has been written by Diana Mousina, Deputy Chief Economist at AMP.

Important note: While every care has been taken in the preparation of this document, neither National Mutual Funds Management Ltd (ABN 32 006 787 720, AFSL 234652) (NMFM), AMP Limited ABN 49 079 354 519 nor any other member of the AMP Group (AMP) makes any representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided. This document is not intended for distribution or use in any jurisdiction where it would be contrary to applicable laws, regulations or directives and does not constitute a recommendation, offer, solicitation or invitation to invest.