Staying the course is sage advice for long-term investors anxious about market volatility — and for good reason

By looking at how markets have performed over time, we can put current events into context and appreciate the benefits of a long-term and well diversified investing strategy.

The following three charts highlight the importance of staying invested and focusing on the long-term when markets are volatile.

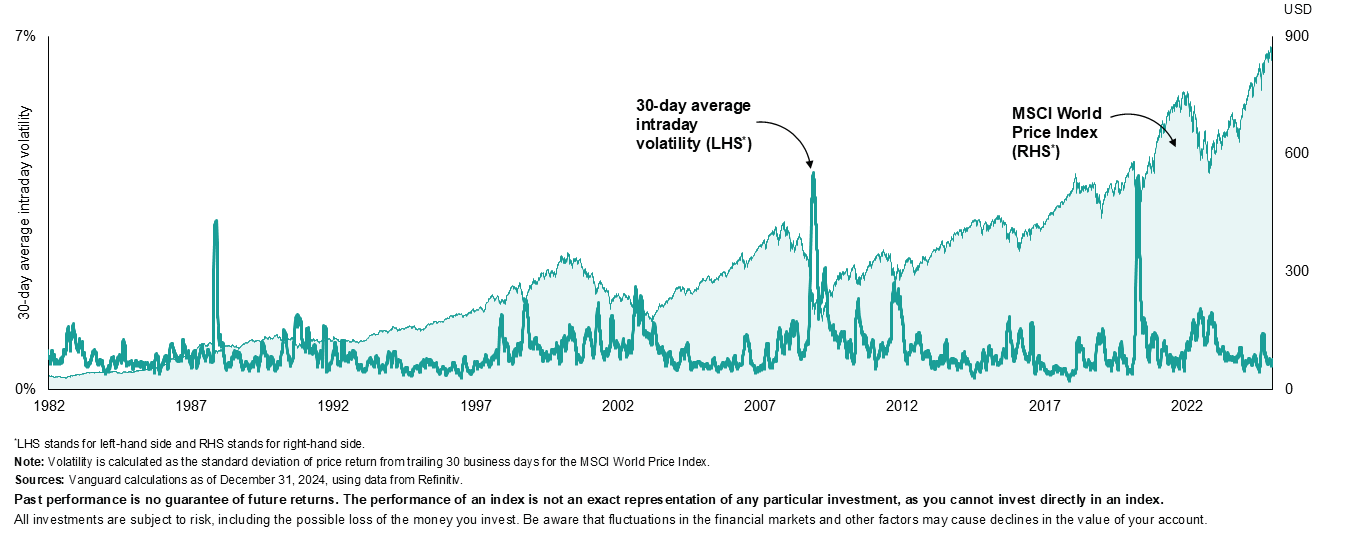

Don’t let turbulence distract you: Keep your focus on the longer term

Volatility and index prices for the MSCI World Price Index (December 31, 1982, through December 31, 2024)

Short-term volatility has forever been part of investing. Extreme and extended cases of volatility have frequently coincided with market pullbacks.

But investors clearly would do well to focus on the long term as global equity returns as measured by the MSCI World Price Index would suggest.

This chart shows that, despite periods of high volatility that have coincided with market pullbacks, equity markets have climbed over the long term.

From December 31, 1982, through December 31, 2024, global equities faced several periods of extreme intraday volatility, most notably after the stock market crash of 1987, the global financial crisis in 2008, and the start of the COVID-19 pandemic in early 2020.

However, despite sharp market pullbacks that coincided with these periods of intraday volatility, global equities have produced strong results over the long term.

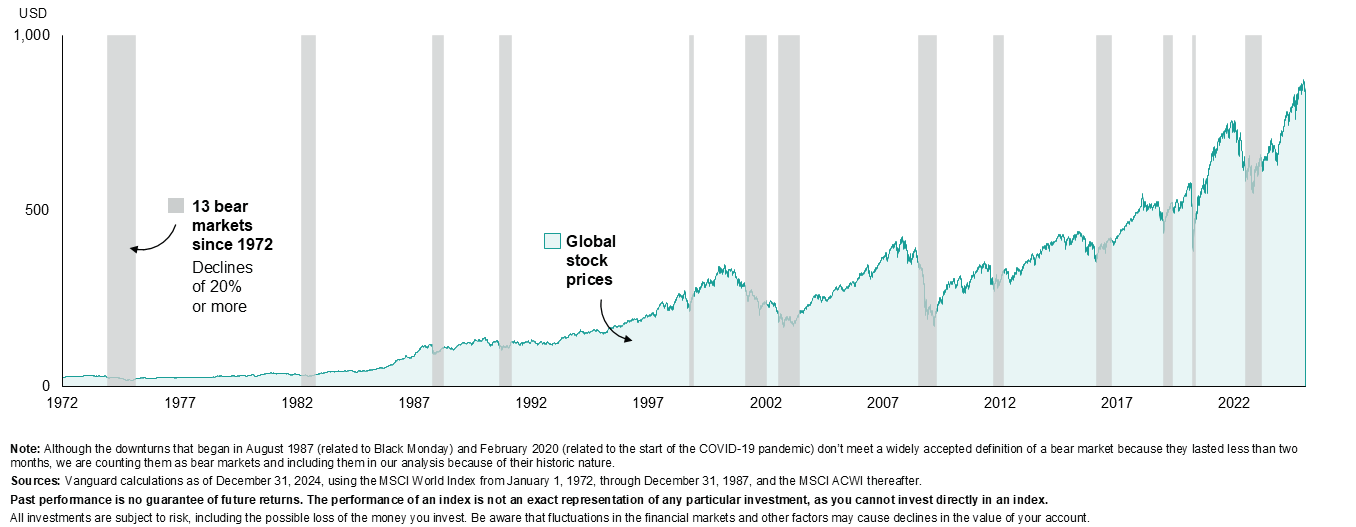

Downturns aren’t rare events: Investors will endure many of them during their lifetime

Global stock prices (January 1, 1980, through December 31, 2024)

Bear markets and corrections are inevitable for investors. Maintaining a long-term focus is the best way to navigate these challenging periods.

From January 1, 1980, through December 31, 2024, the average length of a bull market in global equities has been nearly four times that of a bear market.

It’s worth noting that although the downturns that began in August 1987 (related to Black Monday) and February 2020 (related to the start of the COVID-19 pandemic) don’t meet a widely accepted definition of a bear market because they lasted less than two months, we are counting them as bear markets and including them in our analysis because of their historic nature and the magnitudes of their declines.

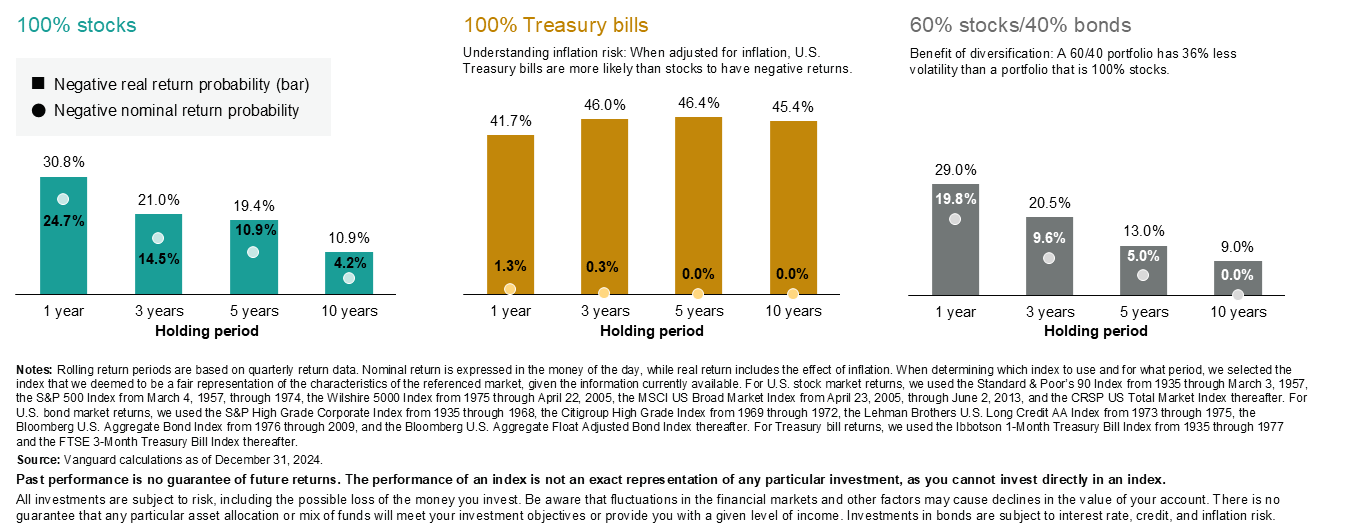

Longer holding periods reduce the chances of a negative return

Historical probability of negative return for various holding periods

The longer you stay invested, the less the historical likelihood that you’ll earn a negative return.

Over a 10-year holding period, investors holding a portfolio of 60% US stocks and 40% high-grade US bonds haven’t had a negative nominal return (not accounting for inflation) and have had significantly less likelihood for negative real returns (accounting for inflation) compared with shorter holding periods. As always, past performance is no guarantee of future returns.

Many investors think of cash and equivalents like US Treasury bills as safer than equities.

But when adjusted for inflation, US Treasury bills have been more likely than stocks to have negative returns.

Focus on what you can control

We believe investors should focus on the things they can control.

That means setting clear investment goals, ensuring your investments are low-cost and diversified (both geographically and across asset classes), and staying focused on the long term.

Source: Vanguard April 2025

Reproduced with permission of Vanguard Investments Australia Ltd

Vanguard Investments Australia Ltd (ABN 72 072 881 086 / AFS Licence 227263) is the product issuer. We have not taken yours and your clients’ circumstances into account when preparing this material so it may not be applicable to the particular situation you are considering. You should consider your circumstances and our Product Disclosure Statement (PDS) or Prospectus before making any investment decision. You can access our PDS or Prospectus online or by calling us. This material was prepared in good faith and we accept no liability for any errors or omissions. Past performance is not an indication of future performance.

© 2025 Vanguard Investments Australia Ltd. All rights reserved.

Important:

Any information provided by the author detailed above is separate and external to our business and our Licensee. Neither our business nor our Licensee takes any responsibility for any action or any service provided by the author. Any links have been provided with permission for information purposes only and will take you to external websites, which are not connected to our company in any way. Note: Our company does not endorse and is not responsible for the accuracy of the contents/information contained within the linked site(s) accessible from this page.