– it’s not clear the proposed reforms will lead to a better outcome for the Australian economy

Dr Shane Oliver – Head of Investment Strategy and Chief Economist, AMP Capital

Introduction

The unveiling of the independent Review of the RBA – “An RBA fit the future” – has received much attention with talk of a radical overhaul of the RBA. However, there is a real risk in grossly exaggerating the problem and undertaking a big change at the RBA with unclear benefits. In particularly there is a danger in assuming the approach employed by some foreign central banks must be better than our own.

RBA “mistakes”

Since the middle of last decade its often thought that the RBA made three key “mistakes” and these are covered as “episodes” of concern in the Review.

-

Arguably running monetary policy too tight in the years ahead of the pandemic such that inflation was below target at the same time that underemployment was high and wages growth very low.

-

Arguably providing too much stimulus to the economy through the pandemic. This included the 0.1% target for the three-year bond yield and forward guidance that it did not expect conditions to be met to raise interest rates until 2024 at the earliest.

-

And arguably being initially too slow to start removing monetary stimulus in the face of rising inflation from 2021.

Some may add another two.

-

Boosting home prices by running overly easy monetary policy – although this would be inconsistent with the first “mistake” above.

-

Raising interest too aggressively over the last year and in the process not allowing for the threat to indebted households and unemployment and or enough time to assess the lagged impact of rate hikes. While I too have concerns on this front its too early to say who is right, particularly with inflation still high and unemployment still very low (and below most estimates of full employment). And by raising rates a bit less (so far) than many other major central banks the RBA has arguably been more balanced in hiking that others have been.

The first led to initial calls for a review of the RBA, and then understandable community angst around the perceived “no rate hikes to 2024” guidance and the rapid pace of hikes has arguably reinforced it.

Key Review recommendations

The Review came up with 51 recommendations to reinforce the monetary policy framework, decision making, culture and governance of the RBA. Putting aside the issues around RBA culture, the key recommendations are as follows:

-

Affirmation of the flexible 2-3% inflation target which “has generally worked well”, although it recommended the RBA’s objectives should be more clearly and equally defined around price stability and full employment.

-

Removal of the “on average, over time” reference to the achievement of the inflation target, which should be replaced with the RBA explaining “how it is using its flexibility”, including “how quickly it is aiming to return inflation to around the midpoint of the target”.

-

Affirmation of RBA independence and that it be strengthened with removal of the power of the Treasurer to overrule it.

-

The separation of the RBA Board from 1 July next year into a Governance Board (with an external chair) to support and oversee the management of the RBA and a dedicated Monetary Policy Board to determine monetary policy.

-

The Monetary Policy Board to be comprised of the RBA Governor as chair, Deputy Governor and Treasury Secretary with 6 external members with expertise in macroeconomics, the financial system, labour markets and the supply side of the economy.

-

The Monetary Policy Board would have formal votes with the 6 external members having the potential to override RBA recommendations.

-

The Monetary Policy Board would move to 8 meetings a year (from 11) to allow for better deliberation.

-

Press conferences after each monetary policy meeting with an increased amount of information to be released.

-

External Monetary Policy Board members to publicly discuss decisions and have access to RBA staff.

The basic central banking model proposed by the Review – of a separate Monetary Policy Board or committee, 8 meetings a year, press conferences after each meeting with all members speaking on monetary policy – is essentially what is undertaken to varying degrees in the UK, US, Canada and New Zealand.

But its not clear that the case for radical change to adopt the proposed foreign model has been made

Looking at the key recommendations of the Review:

-

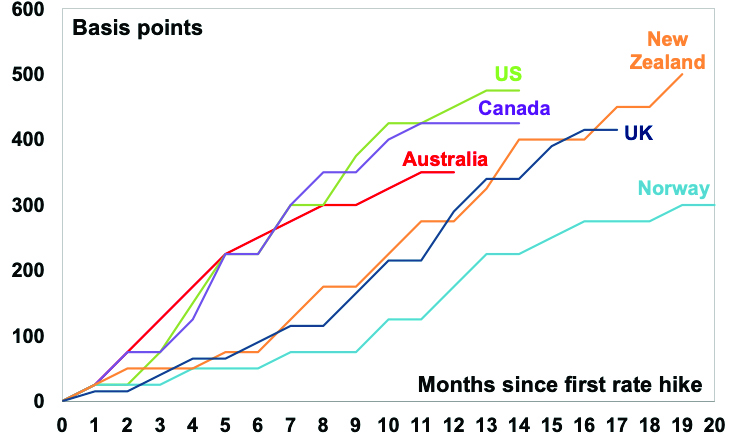

The RBA has already been targeting both price stability and full employment under Governor Lowe – which partly explains why it’s been less aggressive in raising rates than other central banks in raising rates – see the next chart. So, it’s not clear that equalising the objectives of price stability and full employment would really make much difference to the way the RBA does things. Given the debilitating impact of high inflation on the economy, low and stable inflation is a pre-condition for sustained full employment.

Changes in global policy rates since 2021

Source: Bloomberg, AMP

-

It’s not clear that switching to regular press conferences and commentary from external Monetary Policy Board members will add much except more noise and potentially confusion around RBA decisions (as seen in other countries like the US where there are often several Fed speakers commenting on interest rates every day with often differing views) and the RBA already supplies a lot of information (arguably too much).

-

Removal of the “on average, over time” reference to the inflation target with the RBA explaining “how it is using its flexibility” may make the RBA less tolerant of short-term deviations from the inflation target and so could result in more aggressive and volatile moves in interest rates posing a greater threat to full employment.

-

Switching to less meetings may contribute to better quality decisions, but it may also make the RBA less agile, reduce “announcement effects” and necessitate bigger moves as seen by other central banks.

-

Having more monetary policy experts involved in the determination of monetary policy at the Board level is potentially a move in the right direction in that such a Board may be better able to challenge the RBA and add to its views. But it’s not entirely clear that the current Board has been remiss in this regard – Governor Lowe and some Board members don’t seem to see it this way.

-

Yes, the RBA has made some mistakes in recent times. But these have mostly only been clear in hindsight and also partly reflect other factors through a period of extreme economic shocks that wrong footed governments and many economists at times as well. The inflation undershoot prior to the pandemic partly reflected RBA concerns to avoid adding to high levels of household debt with already record low interest rates, along with a Federal Government focussed on fiscal austerity at the time such that monetary and fiscal policy were pushing in opposite directions. The RBA’s excessive stimulus through the pandemic reflected the massive threat at the time, with share markets plunging 35% in a month and talk of deep recession (and in some cases depression) and double-digit unemployment. And its cautious initial response to rising inflation arguably reflected concerns about the fragility of the recovery and a fear that we would simply go back to the chronic low inflation seen in the pre-pandemic period if it moved too quickly to raise interest rates.

-

Having more macroeconomic experts on the Board may at the margin help avert a rerun of some of the RBA’s missteps in relation to yield targeting and communication – particularly the “no rate hike till 2024” guidance, but the RBA has already learned from those experiences and is unlikely to repeat them again anyway.

-

The potential for external members to outvote the RBA members on the Monetary Policy Board (with 6 votes to 2 or 3 depending on whether the Treasury Secretary is included) could create confusion and actually reduce formal internal RBA accountability.

Overall, the recommended changes if fully implemented are unlikely to have a significant impact on the outlook for monetary policy as flexible 2-3% inflation targeting will sensibly remain in place. In particular, there is nothing in the recommendations pointing to a less hawkish RBA that some may have been hoping for. If anything, professional economists on the Monetary Policy Board could be more hawkish. Don’t forget that there are plenty of other central banks – in the UK, NZ, Canada and the US – that have separate monetary policy committees, less meetings and press conferences after each meeting, but which have actually been more aggressive and arguably less balanced in raising interest rates than the RBA has!

A key concern is that it’s questionable whether moving to the separate Monetary Policy Board, less meetings, more press conferences and more speakers on monetary policy model employed in several other countries (the UK, Canada, the US and NZ to varying degrees) is justified when those countries have not necessarily achieved better economic outcomes than the RBA. As the Review itself notes “Australia’s economic performance has been very good since flexible inflation targeting was introduced in the early 1990s” and “at least on a par with other comparable countries” and “there is a broad consensus among those that the Review consulted that the Reserve Bank Board’s actions and the current monetary policy arrangements have contributed significantly to these outcomes”. So if the proposed model is not demonstrably superior, why make the change to it.

Concluding comment

The shift to flexible inflation targeting of 2-3% and RBA independence three decades ago was a monumental shift and since then, in the words of the Review, “Australia’s economic performance has been very good”. Some of what is proposed by the Review has merit but it’s not clear that the basic foreign central banking model proposed is superior to what we have now. We risk throwing out the baby with the bathwater.

Source: AMP Capital April 2023

Important note: While every care has been taken in the preparation of this document, AMP Capital Investors Limited (ABN 59 001 777 591, AFSL 232497) and AMP Capital Funds Management Limited (ABN 15 159 557 721, AFSL 426455) make no representations or warranties as to the accuracy or completeness of any statement in it including, without limitation, any forecasts. Past performance is not a reliable indicator of future performance. This document has been prepared for the purpose of providing general information, without taking account of any particular investor’s objectives, financial situation or needs. An investor should, before making any investment decisions, consider the appropriateness of the information in this document, and seek professional advice, having regard to the investor’s objectives, financial situation and needs. This document is solely for the use of the party to whom it is provided.